Investment

Strategy

Emet makes control investments in distressed debt secured by rental housing assets that qualify for municipal revenue bond financing. Emet seeks to purchase debt securities at a discount to face value, obtain control of the real estate, and then rehabilitate and reposition the assets to increase value.

Emet Employs The Following

Investment Strategy:

- Source superior investment opportunities in distressed debt secured by real estate assets financeable with tax-exempt municipal bonds

- Acquire these securities at deep discounts to stabilized value, targeting at or below underlying real estate liquidation value

- Obtain control of the asset through first mortgage debt instruments or majority ownership of the equity

- Structure investments to produce total return through a combination of current yield and capital appreciation

- Work with a broad network of specialized operating partners to rehabilitate and reposition these assets

- Recapitalize and/or restructure the capitalization to create additional value

- Bring assets to performing status and exit at outsized value step-up through a refinancing and/or sale of the debt securities or underlying assets

- Emet expects the value generated and premium earned to come from three sources: (1) current cash flow from property operations, (2) capital appreciation due to value-add asset repositioning, and (3) the premium for returning the assets to performing status

The team believes that this strategy will further Emet’s additional objective of community enhancement by providing safe, decent, and affordable housing in the neighborhoods in which it invests.

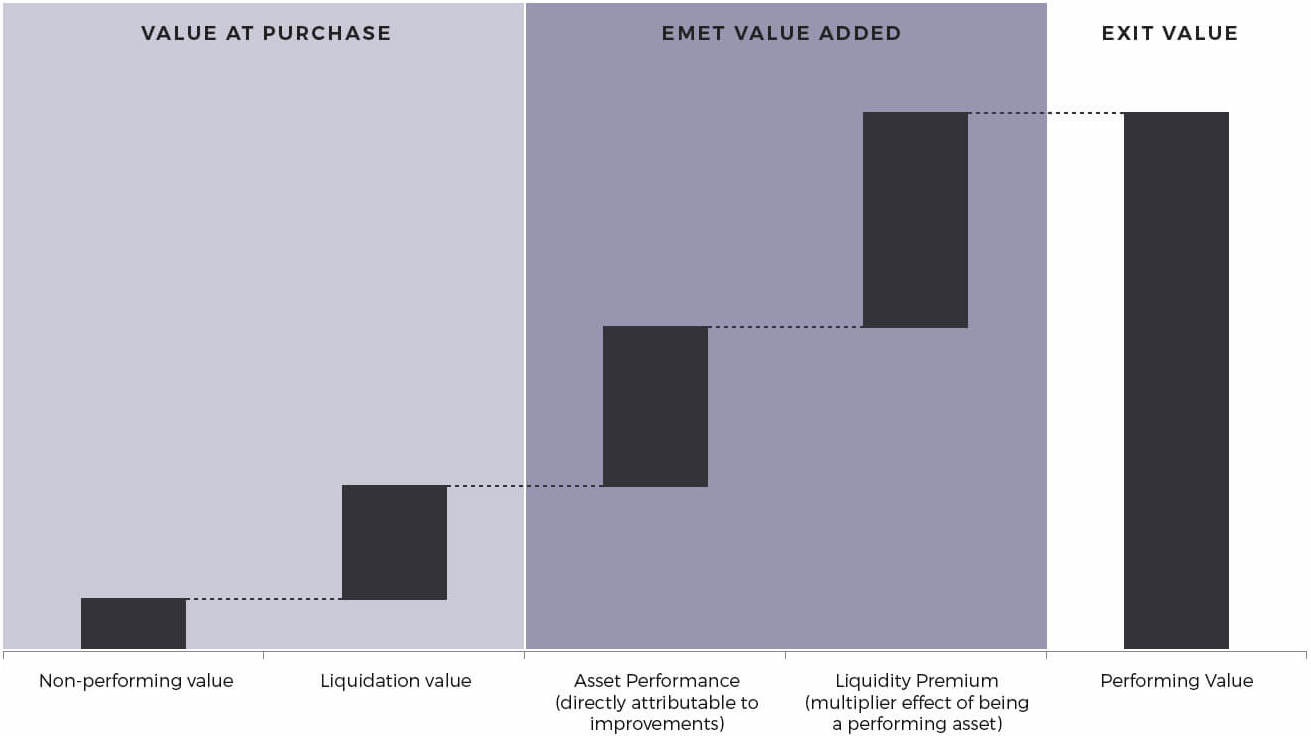

Multiple Sources of Value Can Produce Returns and Mitigate Risk

The chart shows two main phases of an investment– value at purchase and Emet value added.

In the first phase, the asset's value at purchase has a very low non-performing value stepping up to a slightly higher liquidation value.

The second phase depicts the Emet value added with a higher asset performance directly attributable to improvments stepping up to an even higher liquidity premium due to the multiplier effect of being a performing asset.

The final bar shows the full growth of the exit value now that the asset is at a performing value.

* Chart is for illustrative purposes only and does not represent intended or projected profitability

* Chart is for illustrative purposes only and does not represent intended or projected profitability